33+ prorated property tax calculator

For example if the appraised value of. Fast and easy 2016 sales tax tool for businesses and people from Peabody Kansas United States.

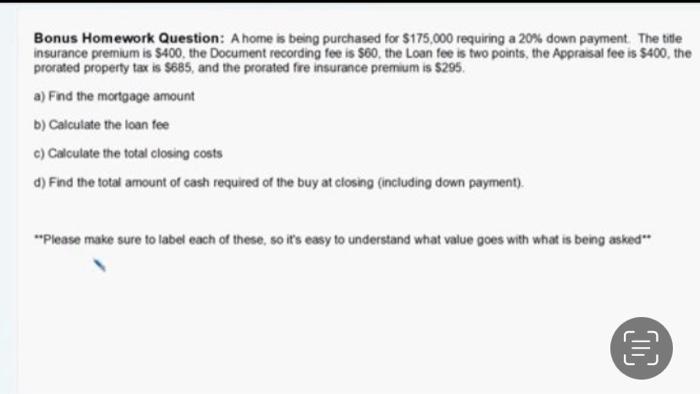

Solved Bonus Homework Question A Home Is Being Purchased Chegg Com

Iowa property taxes are paid in arrears.

. 129 of home value. November 2022 Pay 2023 Second Half Taxes Paid. Web Web To calculate prorated rent when a tenant is moving out you can use the same formula for calculating prorated rent when moving in.

Web The Safe Senior Property Tax Refund is a property tax refund for eligible homeowners age 65 years or older. Tax amount varies by county. The median property tax in Kansas is 162500 per year for a home worth the median value of 12550000.

May 2022 Pay 2023 First Half Taxes Paid. Web Tax Proration Calculator Closing Date. Web Our Kansas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average.

Effective for tax year 1997 the first 20000 in appraised value of your home is exempt from the 20 mill statewide portion of the mill levy. Last year the average property taxes paid. While the exact property tax rate you will pay for your properties is set by the.

Let Our Tax Calculator Tools Help You. Web Free online 2016 US sales tax calculator for Peabody Kansas. Web Tax Proration Calculators Transnation Title Agency Contact Us Locations Order Title Payments Careers Transnation Title Proration Calculators Prorations By Value.

Web Your actual property tax burden will depend on the details and features of each individual property. Web Get To Know Us The County Appraisers Department is responsible for discovering assessing listing and valuing all property within Kingman County. The sales tax rate in Ninnescah township Cowley CountyKansasis85.

- Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or. Web Taxes in Ninnescah township Cowley County Kansas. Web Multiply the daily tax rate by the number of days the seller has owned the property.

In the above example the seller has owned the property for 59 days. Web Property Tax and Millage Calculator Anytime Estimate Please Share Tioga County Venango County Warren County Wayne County York County Property Tax and Millage. Web To calculate prorated rent when a tenant is moving out you can use the same formula for calculating prorated rent when moving in.

Web The property tax estimator assumes that property taxes are paid on September 1st and March 1st. Take the monthly rent and. Web Our closing calculators are more helpful than the most other available closing calculators in that they based on on the inputed price our computer automatically calculate your.

Web Our Premium Calculator Includes. There are several requirements to qualify and the requirements may.

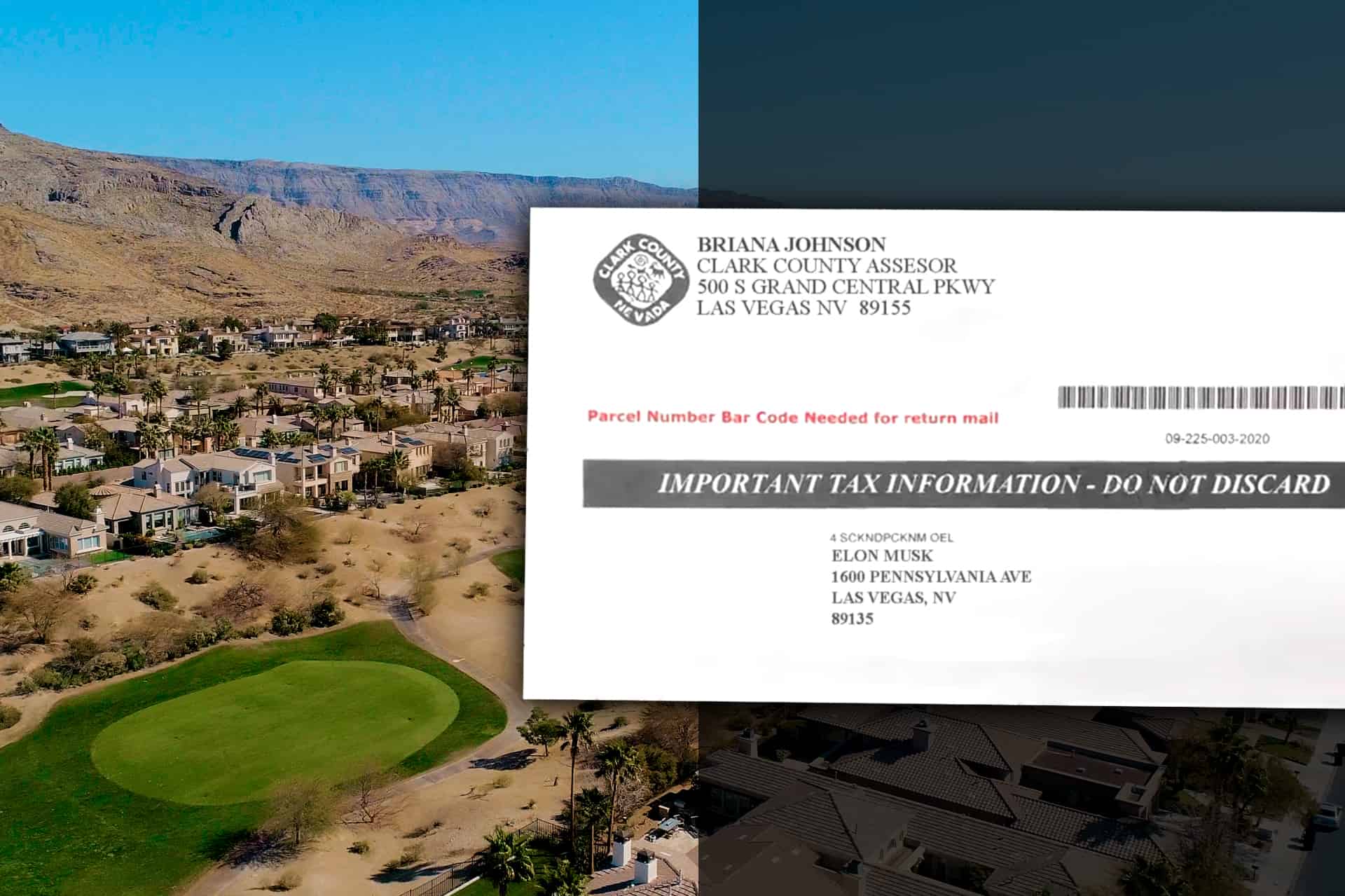

Las Vegas Property Tax Frequently Asked Questions Rob Jensen Company

Property Tax Abatements

Knxuva88a3hzlm

How To Calculate Closing Costs On A Nc Home Real Estate

Tax Advice For U S Citizens In Germany And Europe

The Property Tax Equation

How To Estimate Commercial Real Estate Property Taxes Fnrp

Property Tax Calculations And Prorations Math Worksheet Youtube

Real Estate Legal Pro Tip Before Signing Contract Carefully Consider Tax Proration Language When Contract Price Exceeds Auditor S Valuation Finney Law Firm

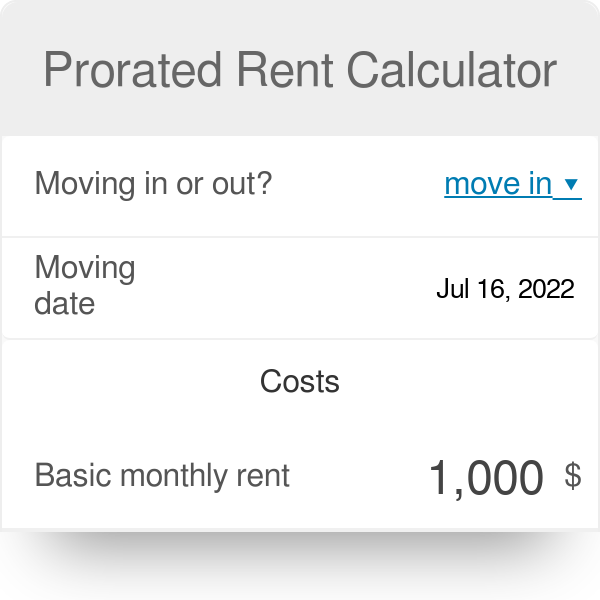

Free Prorated Rent Calculator How To Calculate Prorated Rent

Plains Commerce Bank How Are Property Taxes Calculated

Prorated Rent Calculator Meaning

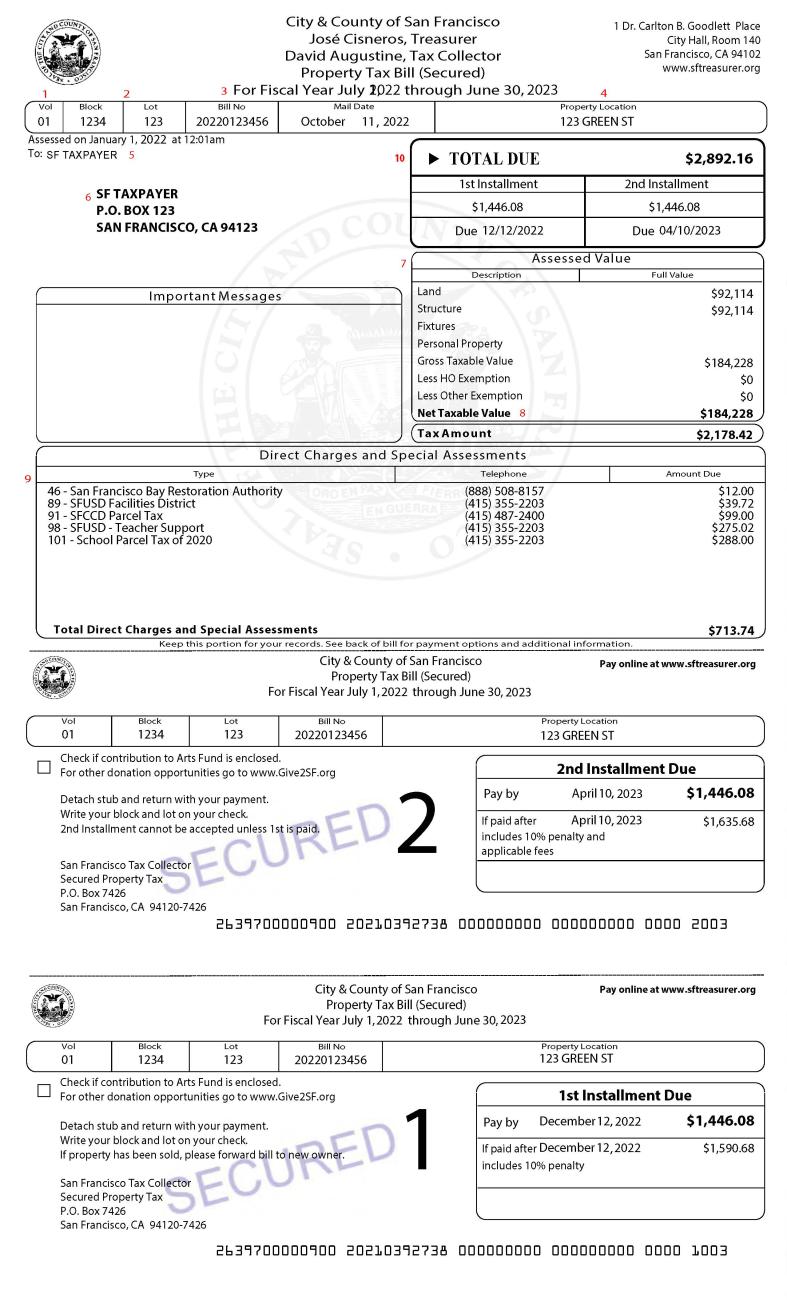

Secured Property Taxes Treasurer Tax Collector

Cv Escrow How Property Tax Prorations Work In Escrow

Real Estate Tax Prorations A Florida Real Estate Exam Math Tutorial Youtube

Honolulu Property Tax Fiscal 2022 2023

How To Calculate Property Tax Prorations